Patent expirations significantly influence drug pricing and treatment accessibility. Research shows that physician-administered therapies experience price reductions of 38–48% after patent expiration, while oral medications typically see a 25% decline. These changes drive increased competition among pharmaceutical companies, leading to broader patient access and potential healthcare cost savings. The ophthalmology sector, particularly in anti-VEGF therapies, is expected to follow similar trends as key drugs lose protection.

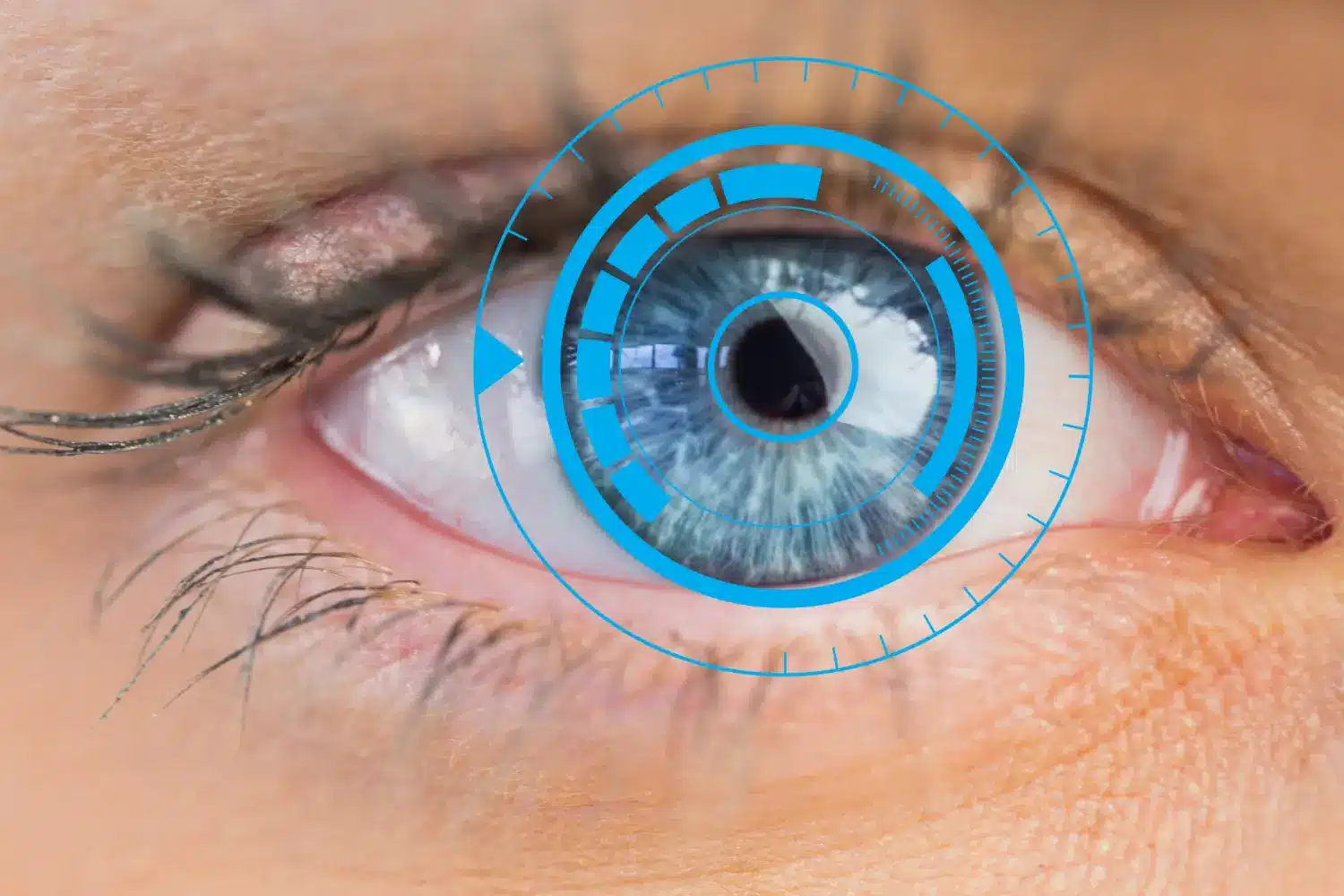

Eylea, a leading treatment for retinal diseases, has been shaped by regulatory exclusivity and patent protections that have defined its market positioning and delayed direct competition. As these protections near their end, the competitive landscape for vision-preserving therapies is poised for major change—impacting treatment choices, pricing structures, and patient access.

In this article, we’ll take a closer look at Eylea’s patent timeline, how its expiration is shaping biosimilar development, and what these changes mean for patients, physicians, and the broader healthcare system.

Key Takeaways

- Eylea (aflibercept) was granted regulatory exclusivity until 2023. Its key U.S. composition patent expired in June 2024, and European protection ends around 2025.

- Patent expiration paves the way for biosimilar development, with companies like Samsung Bioepis, Amgen, and Viatris advancing aflibercept biosimilar candidates for FDA approval.

- Biosimilar approval under the BPCIA requires rigorous analytical studies, clinical trials, and, eventually, data supporting interchangeability for substitution.

- Post-expiry, the retinal treatment market is expected to see 30–50% price reductions, increased competition, and insurer-driven incentives for biosimilar use.

- Regeneron is responding with strategic moves, including the launch of Eylea HD to maintain market share among patients seeking longer dosing intervals.

- For clinicians, the biosimilar era demands education, patient monitoring, and insurance navigation to ensure smooth transitions and continued quality care.

- Patients benefit from expanded access to affordable, effective vision-preserving therapies, reshaping the future of anti-VEGF treatment strategies.

About: Medical Spa RX provides medical practices with premium products at the best prices. If you’re looking to buy Eylea online for your practice, the sales representatives at Medical Spa RX can give you guidance.

Overview of Eylea’s Patent Timeline and Exclusivity Periods

Eylea (aflibercept), co-developed by Regeneron and Bayer, received FDA approval in 2011 to treat several retinal conditions, including wet age-related macular degeneration (AMD), diabetic macular edema, and retinal vein occlusion. Under the Biologics Price Competition and Innovation Act (BPCIA), Eylea was granted 12 years of regulatory exclusivity, officially ending in 2023. However, key patents have provided additional layers of protection beyond exclusivity.

Most notably, the U.S. patent covering aflibercept’s composition of matter expired in June 2024, while secondary patents related to manufacturing processes and formulation strategies may extend certain protections slightly beyond that date. In Europe, Eylea’s Supplementary Protection Certificate (SPC) is expected to expire around 2025.

This staggered expiration timeline allows for biosimilars to enter different global markets at varying speeds, significantly influencing competition, pricing, and patient access across regions dependent on this critical vision-preserving therapy.

Impact of Patent Expiration on Biosimilar Development

The expiration of Eylea’s primary U.S. patent represents a major inflection point for the development of aflibercept biosimilars. With the patent barriers lifting in 2024, leading biopharmaceutical companies such as Samsung Bioepis, Amgen, and Viatris are poised to introduce biosimilar versions into the U.S. market following FDA approval.

Developers are now able to submit Biologics License Applications (BLAs) without the fear of patent infringement litigation, accelerating pathways to commercialization. Many biosimilar candidates have already advanced into Phase III clinical trials, demonstrating comparable efficacy, safety, and quality relative to the reference product.

Moreover, companies are positioning themselves to challenge the dominance of Regeneron’s Eylea by offering more affordable treatment options. This increased competition is likely to impact pricing strategies, drive payer adoption incentives, and ultimately broaden patient access to anti-VEGF therapies.

Understanding Eylea’s mechanism of action—specifically its role as a VEGF inhibitor that binds and neutralizes vascular endothelial growth factors—remains critical for developing biosimilars that faithfully replicate the clinical benefits of the originator product.

Regulatory Considerations for Biosimilar Approval

Approval of an Eylea biosimilar requires strict adherence to regulatory pathways outlined under the BPCIA. Unlike traditional generics, biosimilars must undergo comprehensive evaluation to demonstrate that they are highly similar to the reference biologic without meaningful differences in safety, purity, or potency.

Steps in the biosimilar approval process include:

- Analytical Studies: Detailed molecular characterization to confirm structural and functional similarity to Eylea.

- Animal Studies: Conducted if necessary to support early safety data.

- Clinical Studies: Trials assessing pharmacokinetics, immunogenicity, and efficacy.

- Comparative Clinical Trials: Conducted in at least one major Eylea-approved indication, such as wet AMD.

The FDA may allow extrapolation to additional indications based on scientific justification, though achieving interchangeability status—which permits pharmacy-level substitution—requires additional switching studies. Initially, most biosimilars to Eylea will likely launch with a biosimilar-only designation before pursuing interchangeability in later stages.

Market Dynamics Post-Patent Expiry

Following patent expiration, the retinal treatment market is expected to undergo significant realignment. Historically, biosimilar entry has driven price reductions of 30% to 50% within the first two to three years of competition.

Key market dynamics may include:

- Brand Loyalty and Price Matching: Regeneron may leverage Eylea’s strong brand equity and offer strategic discounts to retain market share.

- Formulary Shifts: Insurers and pharmacy benefit managers will likely prioritize biosimilar adoption to reduce healthcare costs.

- Rebate Strategies: Competitive contracting among healthcare systems and insurers could incentivize biosimilar switching.

- Eylea HD Launch: Regeneron’s introduction of Eylea HD (a high-dose version with extended dosing intervals) is designed to maintain loyalty among patients seeking fewer injections.

Biosimilar manufacturers are also investing heavily in education campaigns to address clinician and patient concerns regarding efficacy and safety compared to the reference product.

Implications for Clinicians and Patient Access

For clinicians, the introduction of Eylea biosimilars brings both opportunities and challenges. While therapeutic equivalence is expected, some patients may express hesitation about switching from a trusted brand.

Important clinical considerations include:

- Confirming Biosimilarity: Reviewing comparative data and published clinical trial results.

- Monitoring Transitions: Tracking patient responses after switching to a biosimilar, especially during initial adoption.

- Navigating Payer Policies: Understanding formulary changes and updated prior authorization requirements.

- Educating Patients: Reassuring patients that biosimilars are held to stringent FDA standards and offer clinical outcomes comparable to Eylea.

From the payer’s perspective, biosimilars promise substantial cost savings that can translate into lower copays and broader coverage. Expanded affordability may open access for patients who previously struggled to afford consistent anti-VEGF therapy.

Clinicians will be pivotal in guiding patients through this transition, ensuring continuity of care and maintaining treatment confidence.

Conclusion

The expiration of Eylea’s core U.S. patent in June 2024 signals a turning point in the ophthalmology landscape. With regulatory exclusivity already concluded and biosimilars advancing rapidly toward approval, significant pricing shifts and expanded patient access are imminent.

As the competitive field intensifies, clinicians, payers, and patients must stay informed to navigate emerging treatment choices. While challenges related to education and adoption exist, the overall impact is expected to be positive, with biosimilars driving down costs and improving access to vision-preserving therapies.

The evolution of the anti-VEGF market reflects broader healthcare trends favoring affordability, innovation, and expanded therapeutic options—benefiting patients worldwide who rely on sight-saving treatments.

FAQs

1. What does Eylea do?

Eylea treats several retinal conditions, including wet AMD, diabetic macular edema, and retinal vein occlusion.

2. How is Eylea administered?

Given as an intravitreal injection (injection into the eye) usually every 4 to 8 weeks, depending on the condition.

3. Are there any common side effects of Eylea?

Yes. Common side effects include eye pain, floaters, and increased intraocular pressure. Serious complications are rare but possible.

4. How does Eylea work?

Eylea blocks VEGF (vascular endothelial growth factor), contributing to abnormal retina blood vessel growth.

5. Is Eylea a permanent cure?

No. Eylea manages the symptoms of retinal conditions but does not cure them. Patients may need ongoing treatment.

6. Are biosimilars of Eylea safe and effective?

Yes, biosimilars must prove they are highly similar to the original product in quality, efficacy, and safety before approval.

7. Will switching to a biosimilar affect my treatment results?

Clinical trials aim to show no meaningful differences. Your eye specialist will guide you on the best treatment approach.

References

Conti R, Berndt ER. Patent expiration and pharmaceutical prices. NBER Digest. 2014;Sep. https://www.nber.org/digest/sep14/patent-expiration-and-pharmaceutical-prices.

When do the Eylea and Eylea HD patents expire? Drugs.com. Published 2023. Accessed April 21, 2025. https://www.drugs.com/medical-answers/eylea-patent-expire-3571144/